What Is a NinjaTrader Strategy?

A NinjaTrader Strategy is an Automated Trading System, also referred to as mechanical trading systems, algorithmic trading, automated trading, or system trading, which allows traders to establish specific rules for both trade entries and exits that, once programmed, can be automatically executed via a computer. The trade entry and exit rules can be based on simple conditions such as a moving average crossover or can be complicated strategies that require a comprehensive understanding of the programming language specific to the user’s trading platform, or the expertise of a qualified programmer. NinjaTrader Automated Trading Systems typically require the use of software linked to a direct access broker and any specific rules must be written in that platform’s proprietary language. NinjaTrader platform utilizes the NinjaScript programming language.

Why use MicroTrends NinjaTrader Automated Trading Systems?

MicroTrends CEO & founder Tom Leeson is a real deal trader & developer actively trading & consulting for prop shops & hedge funds & has been directly involved with algorithmic trading & front desk and back office trade systems development since 1995 onwards commercially in the city of London’s trading arena.

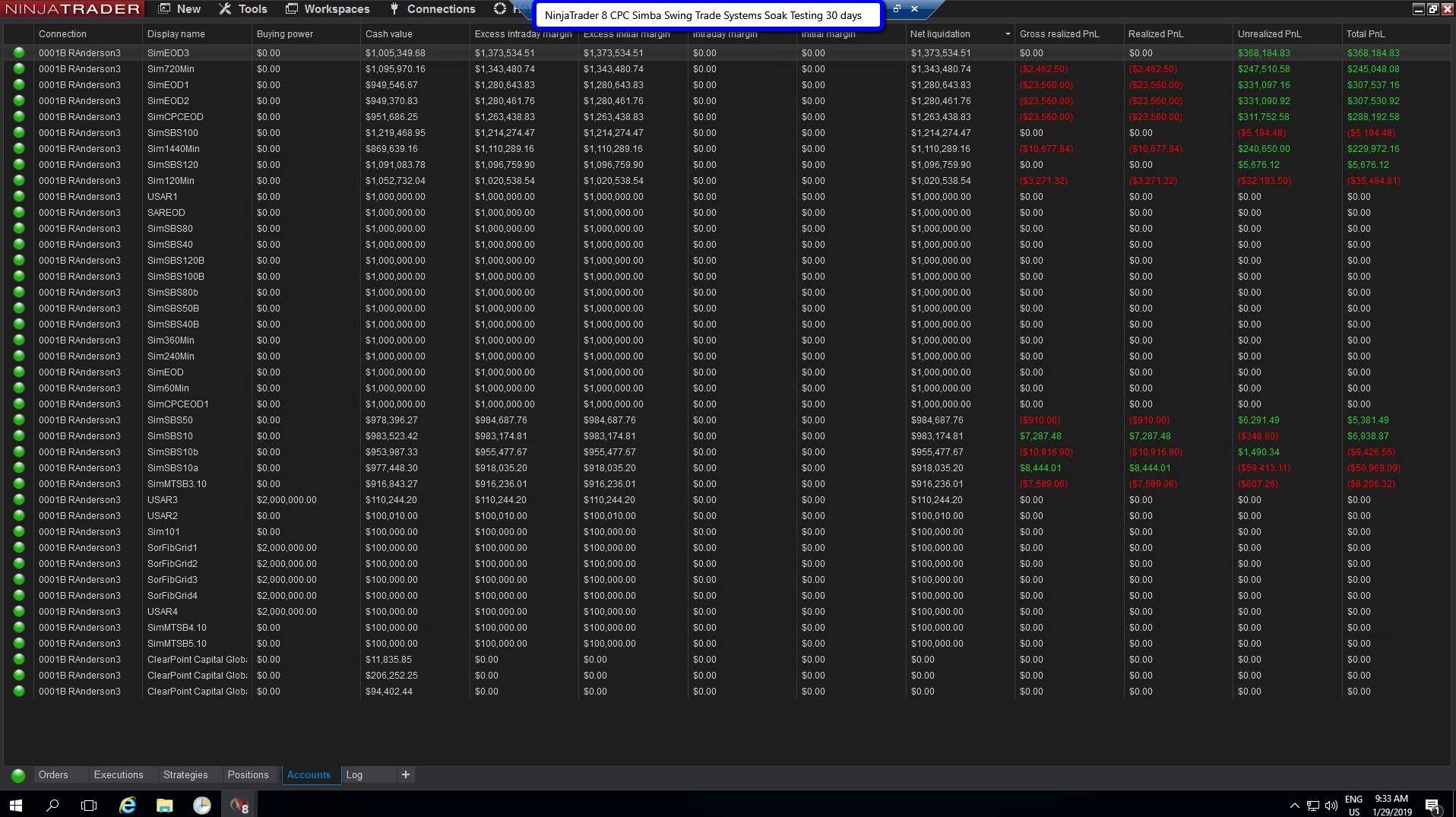

Developing NinjaTrader automated trading systems has been a passion since 2006 allowing MicroTrends to partner with NinjaTrader in 2009 & become a leading developer of automated algorithmic trading strategies in the retail and hedge fund commercial trading side of the futures trading industry for NinjaTrader. Developing & testing 100s of NinjaTrader Strategy projects in NinjaTrader 7 & NinjaTrader 8 over a decade professionally.

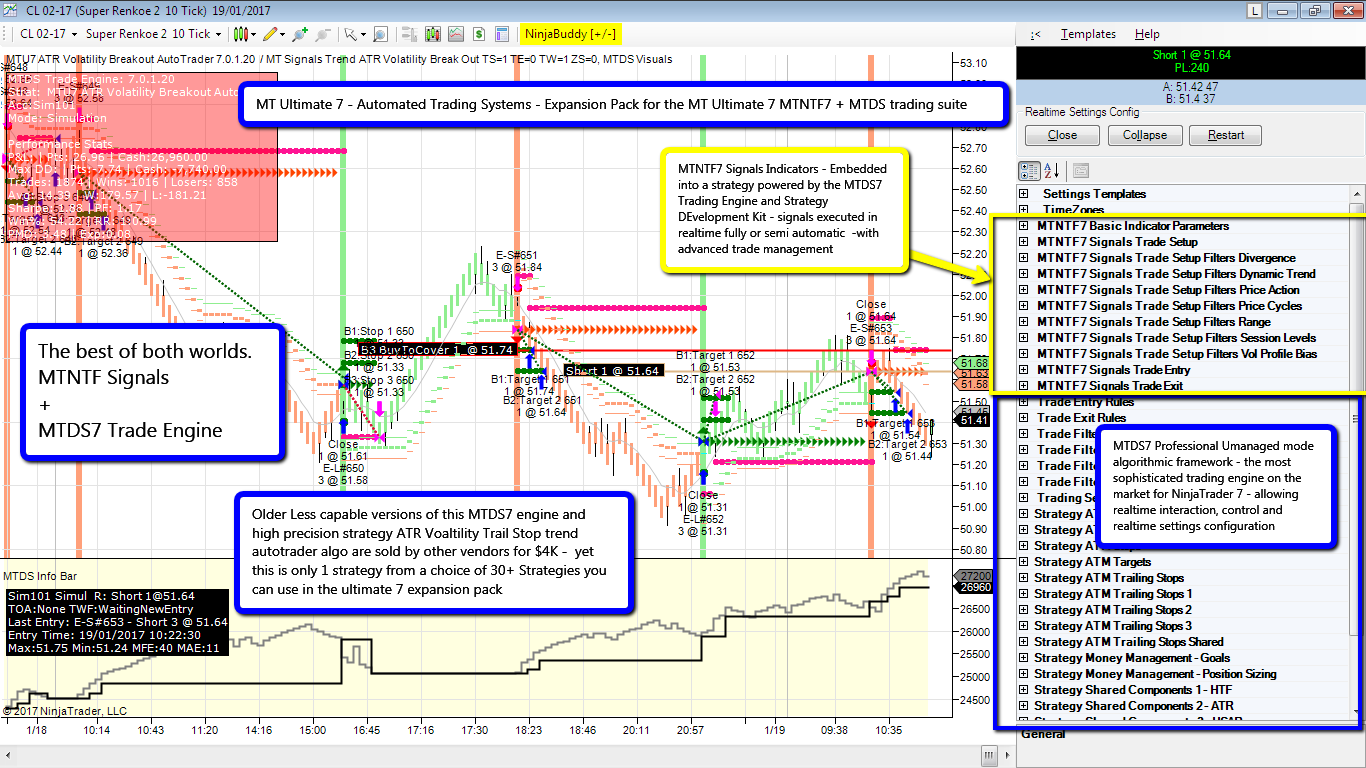

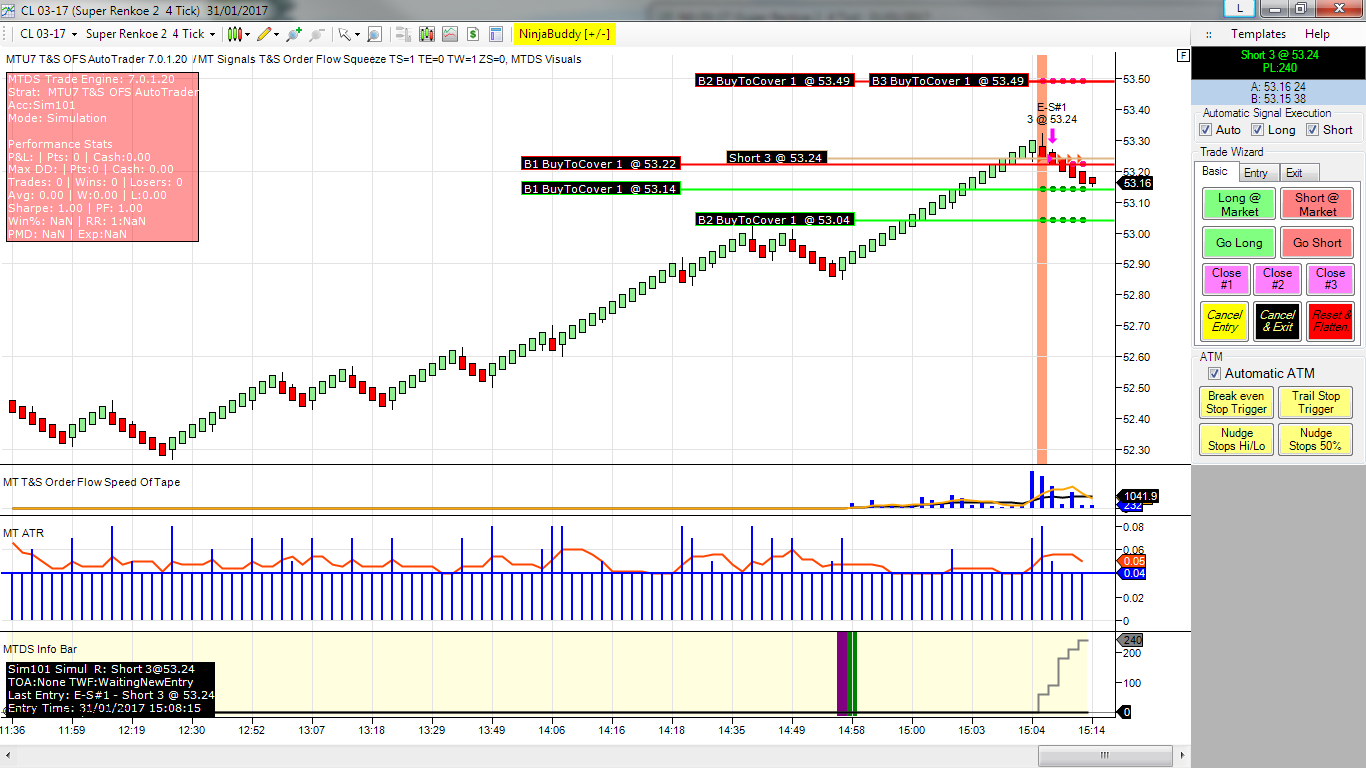

- MicroTrends Trading Software is written by a professional developer providing an institutional grade code base used in a proprietary algorithmic trading framework built on top of NinjaTrader

- Automated Trading Systems designed and tested software in actual live trading successfully in retail & hedge funds such as ClearPoint Capital Managed Futures Fund

- NinjaTrader EcoSystem vendors such as BlueWaveTrading BWT Precision AutoTrader, Woodies CCI CLub NinjaTrader AutoTrader implemented MicroTrends NinjaTrader algorithmic Frameworks to great success

- For more details of Automated Trading System development and algorithmic trading systems consultancy click here to visit NinjaTrader Strategy Development & Consultancy Services

Where to buy Automated Trading Systems online

- Click here to buy your NinjaTrader Automated Trading System online

- Click here to learn more about NinjaTrader Algorithmic Automated Trading

- From 2018/2019 we know offer all our NinjaTrader Strategies and Algorithmic Automated trade management systems via AlgoFuturesTrader who are our sole distributor for all retail NinjaTrader trading strategies & indicators

Important: NinjaTrader AutoTraders Developed in NinjaTrader Professional Unmanaged Mode for unrivaled features, reliability and execution speed and avoidance of Execution Errors and Overfills

The MicroTrends NinjaTrader Automated Trading System code base is professionally written with advanced coding techniques and has many of hours of live market trading and testing. Trade with confidence in real time and real money and know that great attention and care has gone into avoiding and resolving overfills, entry and exit order errors and other potentially dangerous automated trade scenarios – at the core we implement an advanced trade workflow safety engine that avoids trade related errors.

Beware of any strategy that is not written in NinjaTrader’s unmanaged mode or by programmers who have never traded live. Unfortunately, this would be all or most competing automated trading strategies compatible with NinjaTrader…

NinjaTrader Strategy OverFills are a potential serious and dangerous caveat which can occur when the market price reverses and so the system reverses – sending cancellations for working orders prior to the reverse entry, it is possible for exits and entries being filled instead of one being cancelled – thus the balance of the system is out. OverFills can also occur when you place a trade quickly hoping to close a position while a prior order to close the same position already had an in-flight execution. The exact scenarios in which an overfill can occur is highly dependent on the specific strategy programming. By default, NinjaTrader will protect against overfills by halting the strategy, but this is NOT desirable as the strategy closes all positions as a market order with slippage , and deletes the strategy from the chart.

MicroTrends Algorithmic Frameworks for creating and developing NinjaTrader strategy code is perhaps the only NinjaTrader autotrader trading system engine which resolves the issue for both NinjaTrader 7 and NinjaTrader 8 algorithmic trading strategies

GET STARTED Trading Futures for FREE

Learn to trade Futures automated trading risk-free Sim/Demo Trading the NinjaTrader Free Trade Platform

Download NinjaTrader the FREE leading trading platform

NinjaTrader is a FREE trade platform for advanced charting, market analytics, development & simulation

FREE trading platform, free demo account, free real-time data, no risk, no funds required!

1. GET STARTED CLICK HERE TO GET YOUR FREE NINJATRADER PLATFORM & FREE REAL-TIME DATA

Automated Algorithmic & Hybrid Algo Trading Systems

For Traders wishing to use or buy MicroTrends NinjaTrader trading systems

Algorithmic & systematic trading systems for Futures traders and prop firm trading

2. GET STARTED CLICK HERE TO GET YOUR NINJATRADER AUTOMATED TRADING SYSTEMS

NinjaTrader Algorithmic Trading Systems Development & Consultancy

Institutional grade developers from 1995, 2006 Specialist, 2009 Listed NinjaTrader Consultants, B2B Services only

Hire a leading developer NinjaScript consultant for NinjaTrader Automated trading algorithmic systems

3. GET STARTED CLICK HERE TO GET YOUR NINJATRADER DEVELOPMENT QUOTE FOR B2B

Disclaimer, Terms & Risk Disclosure

- In using any MicroTrends websites, services & products you agree to our Terms and Conditions, errors and omissions excluded

- You are responsible to read the Full Risk Disclosure & Disclaimers related to trading

Trading and investment carry a high level of risk, and MicroTrends Ltd does not make any recommendations for buying or selling any financial instruments. We offer educational information on ways to use our sophisticated MicroTrends trading tools, but it is up to our customers and other readers to make their own trading and investment decisions or to consult with a registered investment adviser.