Chart Trading Systems – Systematic Trading Systems

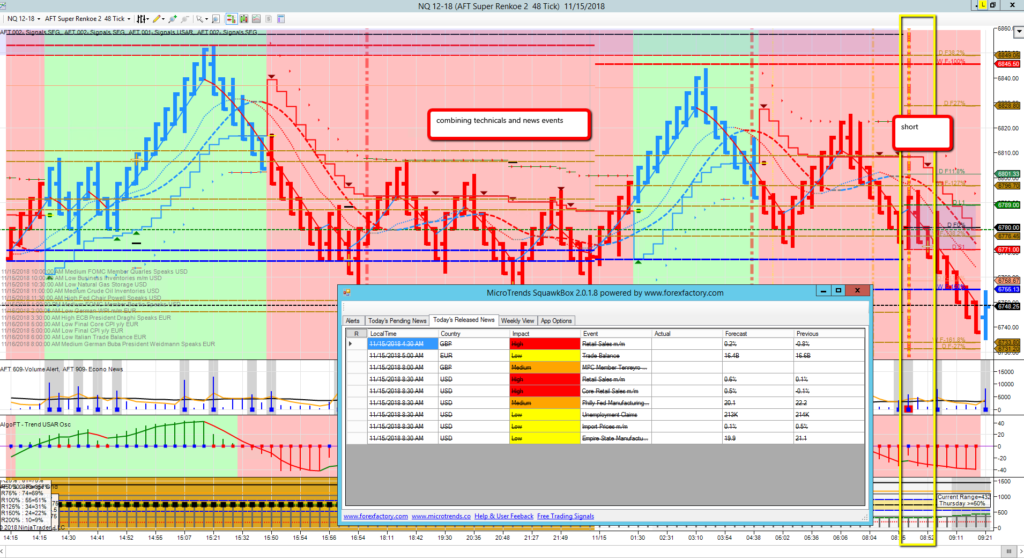

Discretionary trading systems are also known as manual trading systems. A trader uses Chart Trading Indicators manually for trade entry rules, trade filter and trade exit rules. These might set to a specific trade plan and approach or filtered with the use of discretion with external elements such as news, other technicals, triggers, seasonals, cycles, timing and fundamentals. Therefore the entry rule and entry order is manually placed by the trader. When the trader is in a trade position long or short. The trade has to be manually management or automatic trade management applied to bracket the filled order entry position with a set of stop loss and target brackets.

NinjaTrader Indicators

Chart Trading Indicator based Systems are known are accessible from a chart or from the NinjaTrader Market Analzer and are also used within NinjaTrader Strategies as technical enter,filter, exit studies.

- Click here to buy your NinjaTrader Systematic Trading System online

- Click here to learn more about NinjaTrader Indicators

Discretionary trading systems are also known as manual trading systems. A trader uses Chart Trading Indicators manually for trade entry rules, trade filter and trade exit rules. These might set to a specific trad plan and approach or filtered with the use of discretion with external elements such as news, other technical’s, triggers, seasonal’s, cycles, timing and fundamentals. Therefore the entry rule and entry order is manually placed by the trader.

When the trader is in a trade position long or short. The trade has to be manually management or automatic trade management applied to bracket the filled order entry position with a set of stop loss and target brackets.

Charts are a trader’s window to the markets. With the many advances in today’s trading platforms, traders can view vast amounts of market information on their computers. With so much data available, it’s essential to use well-designed charts that enhance, and not hinder, your view of the markets. While the data and tools you choose to include in your charts ultimately have the greatest impact on how you interpret the markets, the overall design of your charts can improve your situational awareness, response time and trading precision.

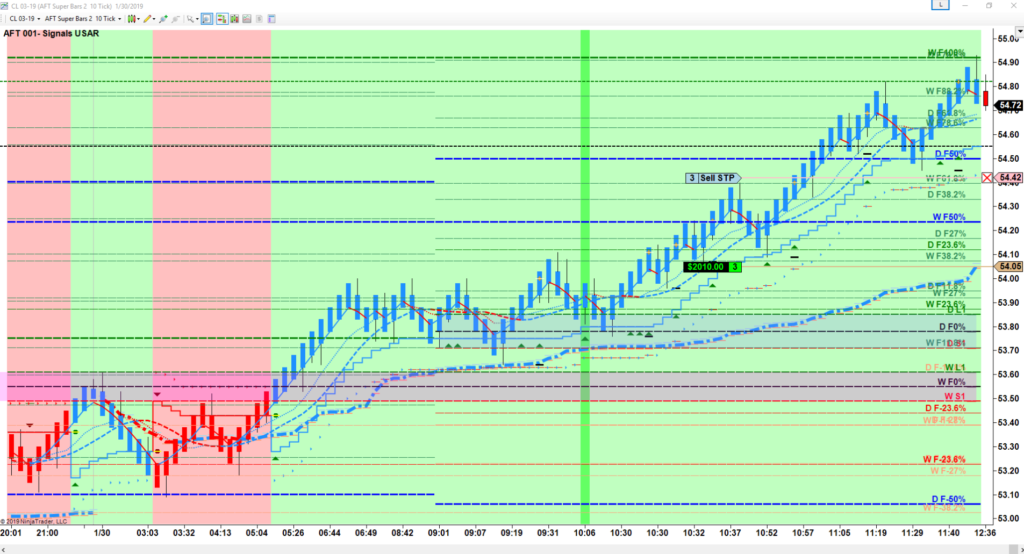

You could have all the right information to make smart trade decisions, but if you can’t find and interpret that data quickly, it is useless; the opportunity will be lost. The faster you can interpret market data, the faster you can react to changing conditions and pounce on trading opportunities. Technical Chart Trading Indicators can make that very much easier allowing visual trade entry rules, trade filter and trade exit rules, alerts, annotations and even voice signals to allow a trader to enter or exit a trade. Technical indicators can be applied to a price chart either as an overlay or as a sub-chart. Overlays are drawn directly over the price bars so signals are on the price or vertically aligned above the chart time series.

Why MicroTrends Chart Trading Systems

MicroTrends CEO & founder Tom Leeson is a real deal trader & developer actively trading & consulting for prop shops & hedge funds & has been directly involved with algorithmic trading & chart trading systems development since 1995 onwards commercially in the city of London’s trading arena. NinjaTrader specialist Since 2006 MicroTrends has specialised with NinjaTrader Indicators Strategies Automated Trading Systems Development and became the premiere leading developer of Automated & Discretionary Trading Systems Online for professional, commercial traders, supplier to vendors in the NinjaTrader community.

NinjaTrader Add-ons & listed NinjaTrader Consultants since 2009 creating proprietary & evolved classical technical analysis trading indicators & strategies, realtime controls and commercial asset/portfolio trading systems- also able leverage Microsoft Enterprise technologies, as well as FIX API for large commercial swing trading and portfolio trading systems – supplying vendors and retail & professional traders with algorithmic trading systems for futures, Forex and Stocks. Click here to learn about us.

MicroTrends Specializes in building proprietary and modified indicators to provide the signals for entry and exits – for more details please visit NinjaTrader Indicators

System-Based vs. Discretionary Trading

There is a certain appeal to developing an automated trading system that requires you to act in a specific way every time market movement sets off a signal. The upside is that, for some traders, it is far easier to maintain a discipline about their trading when there is no discretion in the decision-making process. The downside is that In order to derive the full benefits of a profitable system, the trader must carry out the system’s instructions to the letter.

Being a discretionary trader is no walk in the park either. Discretionary traders have rules to follow, just like their programmer counterparts. The distinction is that discretionary traders apply those rules based on their subjective understanding of each situation. From one trade to the next, there may be significant differences in how the trader’s strategy is implemented. This is not to imply that a discretionary trader can get away with lapses in discipline. Rather, it is because the trader’s decision-making process is subjective that discipline must be in the forefront at all times.

Combining Discretionary Trading and System Trading

Setting Realistic Expectations

How much money can I make?

This question, of course, is in the forefront of every trader’s mind. And, it is an extraordinarily difficult one for the novice trader to answer because of the many variables that can affect earning potential and because the novice trader has no frame of reference with which to establish realistic goals. So, the better question to ask is:

How can I formulate realistic expectations?

With your focus on realistic expectations rather than how much your bank account might swell, you would be wise to take these factors into account:

- Your level of experience

- Which markets you are trading

- The size of your trading account

- Operational expenses

- Your level of risk tolerance

- How much leverage you use

- Whether you are trading full-time

All of these elements are critical components in determining reasonable expectations.

GET STARTED Trading Futures for FREE

Learn to trade Futures automated trading risk-free Sim/Demo Trading the NinjaTrader Free Trade Platform

Download NinjaTrader the FREE leading trading platform

NinjaTrader is a FREE trade platform for advanced charting, market analytics, development & simulation

FREE trading platform, free demo account, free real-time data, no risk, no funds required!

1. GET STARTED CLICK HERE TO GET YOUR FREE NINJATRADER PLATFORM & FREE REAL-TIME DATA

Automated Algorithmic & Hybrid Algo Trading Systems

For Traders wishing to use or buy MicroTrends NinjaTrader trading systems

Algorithmic & systematic trading systems for Futures traders and prop firm trading

2. GET STARTED CLICK HERE TO GET YOUR NINJATRADER AUTOMATED TRADING SYSTEMS

NinjaTrader Algorithmic Trading Systems Development & Consultancy

Institutional grade developers from 1995, 2006 Specialist, 2009 Listed NinjaTrader Consultants, B2B Services only

Hire a leading developer NinjaScript consultant for NinjaTrader Automated trading algorithmic systems

3. GET STARTED CLICK HERE TO GET YOUR NINJATRADER DEVELOPMENT QUOTE FOR B2B

Disclaimer, Terms & Risk Disclosure

- In using any MicroTrends websites, services & products you agree to our Terms and Conditions, errors and omissions excluded

- You are responsible to read the Full Risk Disclosure & Disclaimers related to trading

Trading and investment carry a high level of risk, and MicroTrends Ltd does not make any recommendations for buying or selling any financial instruments. We offer educational information on ways to use our sophisticated MicroTrends trading tools, but it is up to our customers and other readers to make their own trading and investment decisions or to consult with a registered investment adviser.