NinjaTrader Automated Trading Systems transform your trading experience with advanced automation and precision!

Welcome to MicroTrends

At MicroTrends, we specialize in delivering cutting-edge automated trading solutions tailored for the NinjaTrader platform. Our systems are designed to empower traders by enhancing performance, reducing emotional trading decisions, and optimizing efficiency.

Key Features of Our NinjaTrader Automated Systems

- Seamless integration with NinjaTrader 8 for maximum compatibility.

- Fully customizable strategies to suit diverse trading styles.

- Robust backtesting tools to validate performance before live trading.

- Real-time market data integration for precise execution.

- Advanced risk management features to protect your investments.

Why Automate Your Trading?

Automated trading offers numerous advantages, including:

- Consistency: Execute trades based on pre-defined rules without emotional interference.

- Efficiency: Automate repetitive tasks, freeing up your time for analysis and strategy development.

- Scalability: Manage multiple instruments and strategies simultaneously with ease.

- Precision: Leverage algorithmic calculations for accurate trade entries and exits.

How Our Systems Work

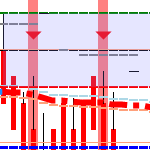

Our NinjaTrader automated trading systems are built using sophisticated algorithms that analyze market data in real-time. Here’s how they function:

- Setup: Install our system on the NinjaTrader platform and configure your settings.

- Backtesting: Use historical data to validate your strategy’s performance.

- Live Trading: Enable the system to execute trades automatically in real-time.

- Monitoring: Monitor performance and make adjustments to optimize results.

GET STARTED Trading Futures for FREE

Learn to trade Futures automated trading risk-free Sim/Demo Trading the NinjaTrader Free Trade Platform

Download NinjaTrader the FREE leading trading platform

NinjaTrader is a FREE trade platform for advanced charting, market analytics, development & simulation FREE trading platform, free demo account, free real-time data, no risk, no funds required! 1. GET STARTED CLICK HERE TO GET YOUR FREE NINJATRADER PLATFORM & FREE REAL-TIME DATA

Automated Algorithmic & Hybrid Algo Trading Systems

For Traders wishing to use or buy MicroTrends NinjaTrader trading systems Algorithmic & systematic trading systems for Futures traders and prop firm trading 2. GET STARTED CLICK HERE TO GET YOUR NINJATRADER AUTOMATED TRADING SYSTEMS