NinjaTrader Strategies

Automated Trading Systems are known as Strategies within NinjaTrader and are accessible from a chart or from the NinjaTrader control center strategies tab.

- Click here to buy your NinjaTrader Automated Trading System online

- Click here to learn more about NinjaTrader Strategies

Why Mechanical Trading with Automated Trading Systems

Most successful traders use a mechanical trading system. This is no coincidence.

A good mechanical trading system automates the entire process of trading. The system provides answers for each of the decisions a trader must make while trading. The system makes it easier for a trader to trade consistently because there is a set of rules which specifically define exactly what should be done. The mechanics of trading are not left up to the judgment of the trader…

The Components of Automated Algorithmic Trading Systems

NinjaTrader Automated Trading Systems cover each of the decisions required for successful trading:

- Markets – What to buy or sell

- Position Sizing – How much to buy or sell

- Entries – When to buy or sell

- Stops – When to get out of a losing position

- Exits – When to get out of a winning position

- Tactics – How to buy or sell – MicroTrends offers you systems that are fully or semi automatic to suit your approach and trade plan!

Curtis Faith.. Original turtle

Why MicroTrends Automated Trading Systems?

Automated Trading Systems are a constant joy & passion for the MicroTrends CEO & founder Tom Leeson, a very experienced trader & developer actively trading & consulting for prop shops & hedge funds & has been directly involved with algorithmic trading & trade systems development since 1995 onwards commercially in the city of London’s trading arena. NinjaTrader specialist Since 2006 MicroTrends has specialised with NinjaTrader Indicators Strategies Automated Trading Systems Development and became the premiere leading developer of Automated & Discretionary Trading Systems Online for professional, commercial traders, supplier to vendors in the NinjaTrader community. Click here to learn about us.

There is a certain appeal to developing an automated trading system that requires you to act in a specific way every time market movement sets off a signal. The upside is that, for some traders, it is far easier to maintain a discipline about their trading when there is no discretion in the decision-making process. The downside is that In order to derive the full benefits of a profitable system, the trader must carry out the system’s instructions to the letter.Developing trading systems, however, is a major undertaking. While some traders are able to use off-the-shelf software programs to back-test historical data, many run into problems. What’s more, everyone seems to be searching for the Holy Grail of trading systems—one so powerful that it is 100% foolproof and yet so secret that it has not been discovered. (Good luck with that!)

Another problem with developing a trading system is that the available market data is often corrupted with inaccuracies. Finally, and most significant of all, is that many developers tend to optimize their systems to the point where they are of no predictive value. Optimization occurs when the developer knowingly or unknowingly “fits” the market data to support a particular conclusion.

Being a discretionary trader is no walk in the park either. Discretionary traders have rules to follow, just like their programmer counterparts. The distinction is that discretionary traders apply those rules based on their subjective understanding of each situation. From one trade to the next, there may be significant differences in how the trader’s strategy is implemented. This is not to imply that a discretionary trader can get away with lapses in discipline. Rather, it is because the trader’s decision-making process is subjective that discipline must be in the forefront at all times.

System trading is rule-based trading, where the decision to make a trade is based entirely upon the trading system. System trading decisions are absolute and do not offer the opportunity to decline to make a trade based on the trader’s discretion. If the criteria are met, the trade is taken.

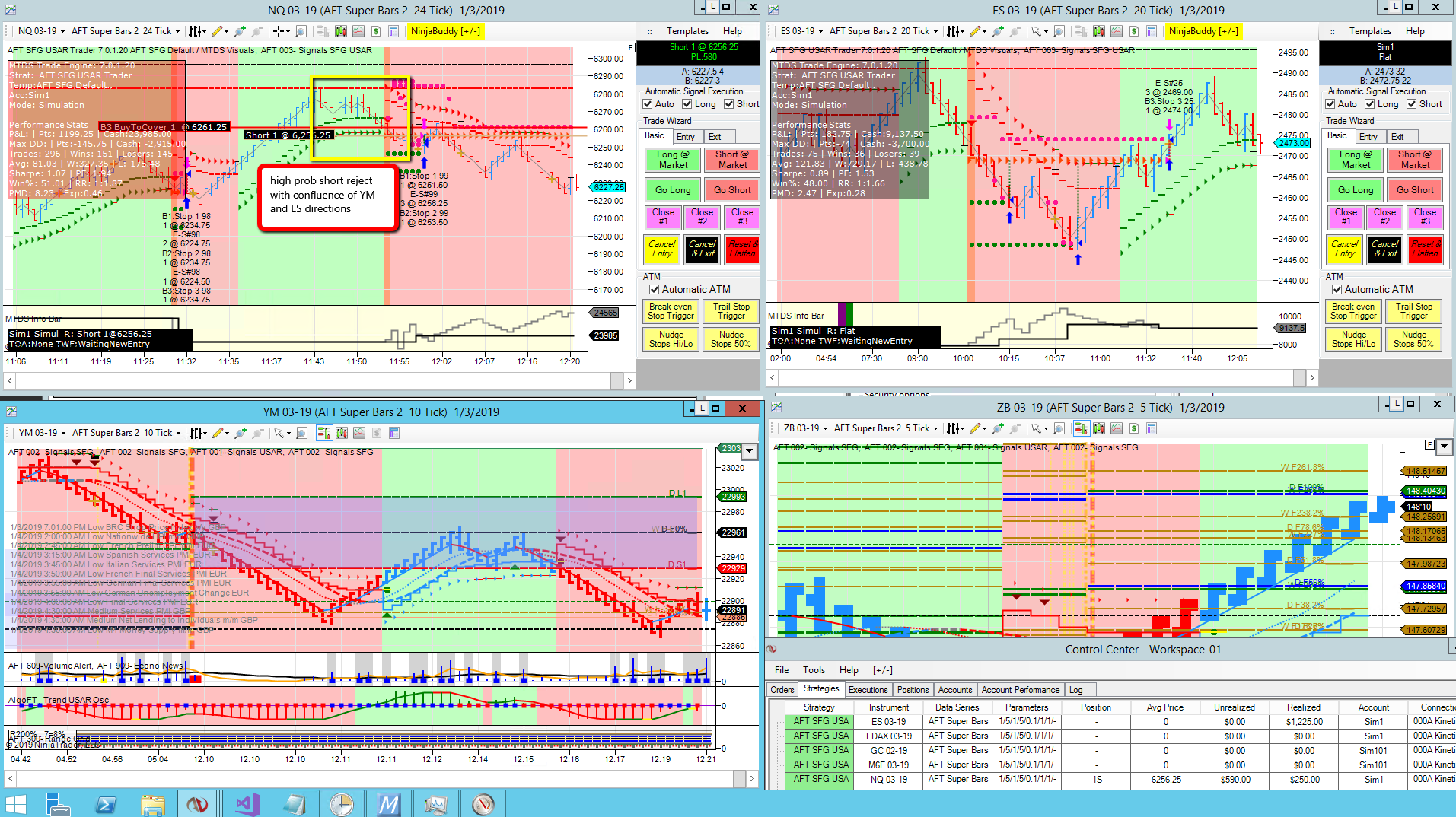

A system trader might review their charts and find that their trading systems requirements for a short trade have been met, so they will make the trade without any further decision-making process…even if their “gut” is telling them it isn’t a good trade.

System trading strategies can often be automated since the rules are so clearly defined that a computer can implement them on the behalf of the trader. Once a computer program has been developed to recognize when a trading systems requirements have been met, the program can make the trade (including the entry, management, and exit) without any involvement of the trader.

The advantage of the system trading strategy is that it is not susceptible to the psychological whims of the trader. The system takes all trades, regardless of the trader’s feeling.

The disadvantage is that a systematic trading strategy is not very adaptive. Trades are always taken as long as the conditions are met, which means even in unfavorable conditions trades will be taken. To help alleviate this problem, more rules can be added to the system, although this often results in cutting out some winning trades as well.

Why traders use Automated Trading Systems

One major reason why traders utilize NinjaTrader Algorithmic Automated Trading Systems is that it removes emotion from the trading experience.

Trading strategies can be trialed before going live (a process called backtesting), and are faster in execution than traditional trading. There are numerous problems associated with removing the human element from trades that need to be avoided, however. Flaws in set up can quickly become costly, and technical failures can be problematic. NinjaTrader Automated Trading Systems need monitoring to ensure that they are performing as intended.

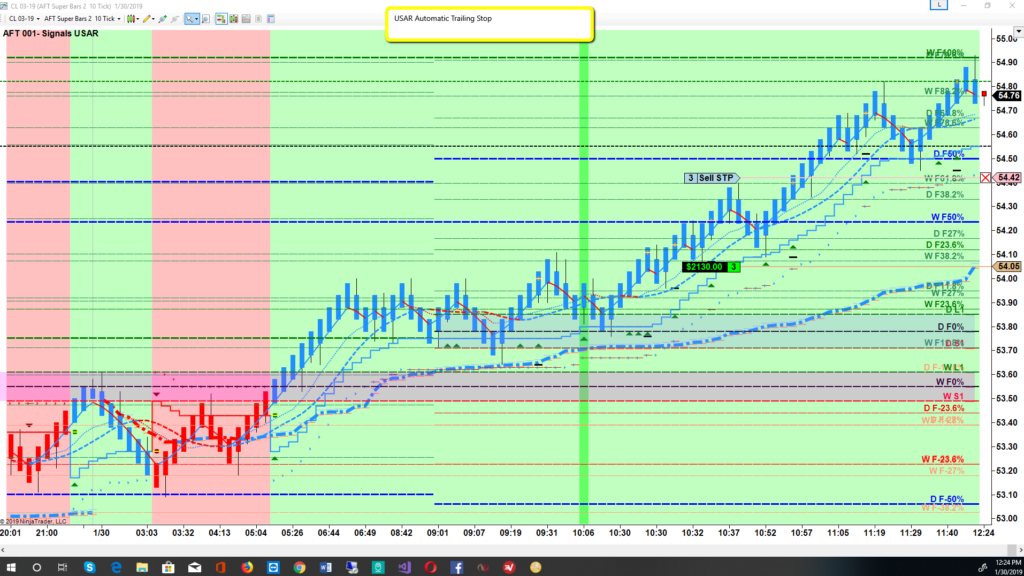

Once the rules have been established, the computer can monitor the markets to find buy or sell opportunities based on the trading strategy specifications. Depending on the specific rules, as soon as a trade is entered, any orders for protective stop losses, trailing stops and profit targets will automatically be generated. In fast moving markets, this instantaneous order entry can mean the difference between a small loss and a catastrophic loss in the event the trade moves against the trader.

Traders and investors can turn precise entry, exit and money management rules into automated trading systems that allow computers to execute and monitor the trades. One of the biggest attractions of strategy NinjaTrader Automated Trading Systems is that it can take some of the emotion out of trading since trades are automatically placed once certain criteria are met. This article will introduce readers to and explain some of the advantages and disadvantages, as well as the realities, of automated trading systems.

Diversify Trading. NinjaTrader Automated Trading Systems permit the user to trade multiple accounts or various strategies at one time. This has the potential to spread risk over various instruments while creating a hedge against losing positions. What would be incredibly challenging for a human to accomplish is efficiently executed by a computer in a matter of milliseconds. The computer is able to scan for trading opportunities across a range of markets, generate orders and monitor trades.

Improved Order Entry Speed. Since computers respond immediately to changing market conditions, automated systems are able to generate orders as soon as trade criteria are met. Getting in or out of a trade a few seconds earlier can make a big difference in the trade’s outcome. As soon as a position is entered, all other orders are automatically generated, including protective stop losses and profit targets. Markets can move quickly, and it is demoralizing to have a trade reach the profit target or blow past a stop loss level – before the orders can even be entered. NinjaTrader Automated Trading Systems prevents this from happening.

There is a long list of advantages to having a computer monitor the markets for trading opportunities and execute the trades, including:

Minimize Emotions. NinjaTrader Automated Trading Systems minimize emotions throughout the trading process. By keeping emotions in check, traders typically have an easier time sticking to the plan. Since trade orders are executed automatically once the trade rules have been met, traders will not be able to hesitate or question the trade. In addition to helping traders who are afraid to “pull the trigger”, automated trading can curb those who are apt to overtrade – buying and selling at every perceived opportunity.

Ability to Backtest. NinjaTrader Automated Trading Systems Backtesting applies trading rules to historical market data to determine the viability of the idea. When designing a system for automated trading, all rules need to be absolute, with no room for interpretation . Traders can take these precise sets of rules and test them on historical data before risking money in live trading. Careful backtesting allows traders to evaluate and fine-tune a trading idea, and to determine the system’s expectancy – the average amount that a trader can expect to win (or lose) per unit of risk.

Preserve Discipline. Because the trade rules are established and trade execution is performed automatically, discipline is preserved even in volatile markets. Discipline is often lost due to emotional factors such as fear of taking a loss, or the desire to eke out a little more profit from a trade. NinjaTrader Automated Trading Systems trading helps ensure that discipline is maintained because the trading plan will be followed exactly. In addition, pilot-error is minimized, and an order to buy 100 shares will not be incorrectly entered as an order to sell 1,000 shares.

Achieve NinjaTrader Automated Trading Systems performance Consistency. One of the biggest challenges in trading is to plan the trade and trade the plan. Even if a trading plan has the potential to be profitable, traders who ignore the rules are altering any expectancy the system would have had. There is no such thing as a trading plan that wins 100% of the time – losses are a part of the game. But losses can be psychologically traumatizing, so a trader who has two or three losing trades in a row might decide to skip the next trade. If this next trade would have been a winner, the trader has already destroyed any expectancy the system had. Automated trading systems allow traders to achieve consistency by trading the plan.

Server-Based NinjaTrader Automated Trading Systems. Traders do have the option to run their automated trading systems through a server-based trading platform such as Strategy Runner. These platforms frequently offer commercial strategies for sale, a wizard so traders can design their own systems, or the ability to host existing systems on the server-based platform. For a fee, the automated trading system can scan for, execute and monitor trades – with all orders residing on their server, resulting in potentially faster, more reliable order entries.

NinjaTrader Automated Trading Systems trading systems boast many advantages, but there are some downfalls of and realities to which traders should be aware. Mechanical failures. The theory behind NinjaTrader Automated Trading Systems makes it seem simple: set up the software, program the rules and watch it trade. In reality, however, automated trading is a sophisticated method of trading, yet not infallible. Depending on the trading platform, a trade order could reside on a computer – and not a server. What that means is that if an Internet connection is lost, an order might not be sent to the market. There could also be a discrepancy between the “theoretical trades” generated by the strategy and the order entry platform component that turns them into real trades. Most traders should expect a learning curve when using automated trading systems, and it is generally a good idea to start with small trade sizes while the process is refined.

Monitoring. Although it would be great to turn on the computer and leave for the day, automated trading systems do require monitoring. This is due do the potential for mechanical failures, such as connectivity issues, power losses or computer crashes, and to system quirks. It is possible for an automated trading system to experience anomalies that could result in errant orders, missing orders, or duplicate orders. If the system is monitored, these events can be identified and resolved quickly.

Over-optimization.

Though not specific to NinjaTrader Automated Trading Systems, traders who employ backtesting techniques can create systems that look great on paper and perform terribly in a live market. Over-optimization refers to excessive curve-fitting that produces a trading plan that is unreliable in live trading. It is possible, for example, to tweak a strategy to achieve exceptional results on the historical data on which it was tested. Traders sometimes incorrectly assume that a trading plan should have close to 100% profitable trades or should never experience a drawdown to be a viable plan. As such, parameters can be adjusted to create a “near perfect” plan – that completely fails as soon as it is applied to a live market.

GET STARTED Trading for FREE – Learn to trade Futures automated trading risk-free Sim/Demo Trading the NinjaTrader Free Trade Platform

Download NinjaTrader the FREE leading trading platform

NinjaTrader is a FREE trade platform for advanced charting, market analytics, development & simulation

FREE trading platform, free demo account, free real-time data, no risk, no funds required!

1. GET STARTED CLICK HERE TO GET YOUR FREE NINJATRADER PLATFORM & FREE REAL-TIME DATA

Automated Algorithmic & Semi Automatic Discretionary Trading Systems

For Traders wishing to use or buy MicroTrends NinjaTrader trading systems

Algorithmic & systematic trading systems for CFDs, Cryptos, ETFs, Forex, Futures, and Stocks.

2. GET STARTED CLICK HERE TO GET YOUR NINJATRADER ALGORITHMIC TRADING SYSTEMS

NinjaTrader Algorithmic Trading Systems Development & Consultancy

Institutional grade developers from 1995, 2006 Specialist, 2009 Listed NinjaTrader Consultants, B2B Services only

Hire a leading developer NinjaScript consultant for NinjaTrader Automated trading algorithmic systems

3. GET STARTED CLICK HERE TO GET YOUR NINJATRADER DEVELOPMENT QUOTE FOR B2B

Please note the following changes to MicroTrends products and services as of Jan 2018

- Since 2018 MicroTrends no longer provides sales and products direct to retail traders – those who bought software in the past are still able to get license support and tech support from the MicroTrends help desk.

Disclaimer, Terms & Risk Disclosure

- In using any MicroTrends websites, services & products you agree to our Terms and Conditions, errors and omissions excluded

- You are responsible to read the Full Risk Disclosure & Disclaimers related to trading

Trading and investment carry a high level of risk, and MicroTrends Ltd does not make any recommendations for buying or selling any financial instruments. We offer educational information on ways to use our sophisticated MicroTrends trading tools, but it is up to our customers and other readers to make their own trading and investment decisions or to consult with a registered investment adviser.